Statistics show that the majority of Maryland car accident cases involving injuries are settled before they go to trial. The victim and the responsible party’s insurer usually come to an agreement on the amount intended to compensate for all losses, including medical treatment, pain and suffering, lost wages, and other damages. However, there’s a lot that goes on behind the scenes as the parties approach the settlement process: It’s not as easy as one side making a demand, reviewing a possible counteroffer, and reaching an agreement somewhere in between. You must have a strategy in place for settlement negotiations to obtain the highest possible amount available under the law, and your personal injury attorney knows about these best practices for the process.

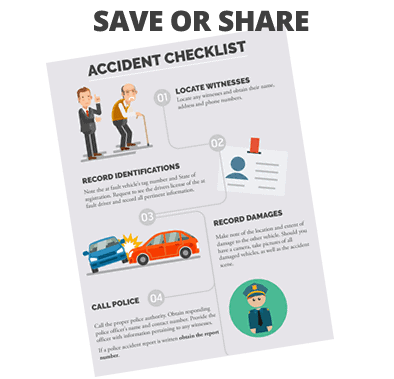

Information Gathering: The first step in opening up settlement negotiations is to collect all information related to your car accident, so you have factual support for your claims. The information gathering stage actually begins in the immediate aftermath of the collision, noting all the circumstances surrounding the crash. You’ll also need to access all medical records involved with your treatment. Any documents regarding procedures at the ER, surgeries, aftercare, and long-term treatment will be relevant. In addition, you should make a list of all potential witnesses to the accident, including passengers in your car and bystanders.

Present a Demand to the Insurance Company: Your next move is to prepare and submit a demand package to the insurance company that provides coverage for the driver that caused the accident. The packet will include all the documents you’ve collected to support your claim, along with a letter to the insurer. In the communication, you should describe how the accident happened, the reasons the other driver is responsible, the details of your injuries and treatment, and the losses you’ve suffered as a result. In concluding the letter, you identify a dollar value that you’d be willing to accept to settle your claim.

The Insurer Evaluates Your Claim and Responds: An insurance company agent will take time to evaluate your claim and all information you’ve included in your demand package. Once the evaluation is complete, the agent will contact you with a response – either by phone or in a response letter. The insurer may deny your entire claim because the evidence doesn’t support it or the facts don’t establish liability of the policyholder. However, it’s more likely that the response will be a counteroffer to settle for an amount lower that what you’ve demanded. Often, negotiations will go back and forth for some time, so it’s important to be patient.

Your Next Move: If you and your lawyer are unable to reach a settlement agreement, you may need to file a lawsuit in court. Note that you must do so within three years of the collision: Maryland’s statute of limitations requires you to sue within that time, or you lose that right forever.

As you can see, the settlement process is quite complex because – even though you don’t have to prove your case in court – you still have to convince the responsible party’s insurance company that you’re entitled to the compensation you’re seeking. Having an experienced car accident attorney on your side increases the chances of obtaining a fair and reasonable settlement amount. Lawyers know the law, so they know what your case is worth; they also know when it’s time to cease negotiations and take the matter to court. For more information on the settlement process, please contact attorney Michael A. Freedman.

See Related Blog Posts: